9 min read

Sustainability Reporting in the US in 2025: Changes in Timing, Titles, and Tone

6 min read

Contrary to speculation that fewer companies are producing sustainability reports in 2025, Datamaran’s latest analysis suggests otherwise. US companies are not stepping back from sustainability, but they’re changing when and how they communicate it.

Using data sourced from the Datamaran platform, we analyzed sustainability reporting trends across major global indices.

The findings reveal that while reporting rates remain strong, US companies are diverging from their European peers in the timing of their reporting, with stateside firms also favoring the term “sustainability” over “ESG”.

Global Comparison: The US Is the Outlier in 2025

Across Europe and the UK, sustainability reporting* remains nearly universal. Every company in the FTSE100 (UK), DAX (Germany), CAC (France), AEX (Netherlands), IBEX (Spain), FTSEMIB (Italy), and SMI (Switzerland) indices published a sustainability report in 2025 – a consistent 100% reporting rate.

By contrast, 75% of S&P 500 companies (375) have published a sustainability report so far this year. While that may appear to represent a decline from 2024 (when 93% published), the difference appears to be largely a matter of timing.

By this time last year, 88% of S&P 500 companies (439) had released their reports, with another 5% (26) publishing theirs in the final quarter of the year. It appears that, amid market uncertainty, companies are delaying publication rather than discontinuing their reports.

Interestingly, seven S&P 500 companies (1%) that didn’t publish a sustainability report in 2024 have done so in 2025.

Timing Trends: Reports Arriving Later

For the 74% (368) of S&P 500 companies that published sustainability reports in both 2024 and 2025, nearly half (48%) of them released their 2025 reports at a later date than in 2024.

-

52% published in the same month.

-

48% published in a later month.

-

The average delay was 4.6 months.

The table below compares this year's report publication timing against last year's. The percentages have been calculated based only on the companies that published later than the previous year (48% of the total).

|

Length of delay |

% of companies |

|

1 to 2 months later |

47% |

|

3 to 5 months later |

20% |

|

6 to 8 months later |

5% |

|

9 to 11 months later |

28% |

While there is clear evidence that companies are publishing reports later, the reasons for this shift remain varied and may depend on internal reporting cycles, resource allocation, changing regulatory expectations, and other factors. Still, sustainability reporting remains a consistent practice among most large listed US companies.

ESG Is Out, Sustainability Is In

The change isn’t just about when companies report, it’s also about what they call their reports.

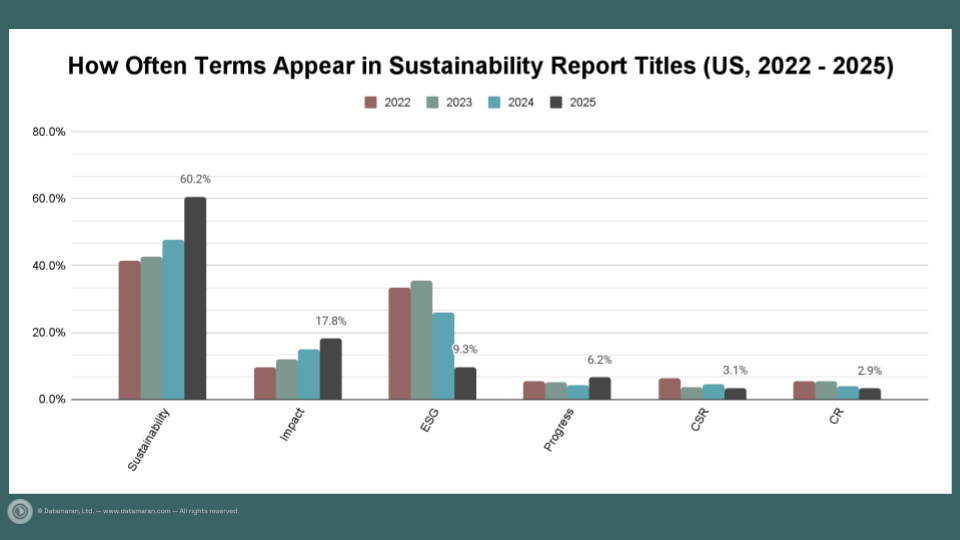

Datamaran analyzed over 1,100 sustainability reports issued by US companies between 2022 and 2025 to understand how report titles are evolving. The data reveals a decisive shift away from “ESG,” with the term “Sustainability” increasing in favor.

-

In 2025, 60% of companies include the term "sustainability" in their report titles, increasing by 13 percentage points from 2024 and 19 from 2022.

-

The term "ESG" and its variations appear in 9% of report titles, decreasing by 16 points compared to 2025 and 24 compared to 2022.

-

The use of the term "impact" is found in 17.8% of report titles, showing three point growth since 2024 and eight since 2022.

This linguistic shift reflects a broader communications strategy. Many companies are opting to frame sustainability as a long-term business imperative rather than what has become a politically charged acronym.

Recalibrating the Narrative: DEI and Beyond

The shift in timing and terminology also extends to the language used in reports. In our September research report on the evolution of DEI (Diversity, Equity, and Inclusion) language in corporate disclosures, Datamaran identified a clear trend toward "narrative recalibration."

- Only 16% of 10-K filings reduced identity-based language, but 37% of sustainability reports either removed or reframed it.

- 33% of companies changed or moved DEI sections to corporate websites.

- 77% of companies that reduced DEI terminology simultaneously increased their use of broader social terms.

Rather than withdrawing from DEI, companies appear to be adapting their tone – maintaining substance while choosing language that feels more balanced and less politicized.

As we said in our latest report, DEI is still embedded in compliance and risk disclosures. Trends like the 10-K filing reduction illustrate a strategic backstop. Inclusion may be less visible, but it's still reinforced as a governance priority.

The Bottom Line

The 2025 sustainability reporting landscape in the US isn’t defined by retreat but by realignment. Most large listed US companies continue to publish sustainability reports, many with later publication dates or shifts in tone and terminology, while European counterparts are maintaining similar publication rates and standards to previous years.

In short, 2025 is not the year US companies stopped reporting on sustainability – it’s the year they adjusted how they communicate it.

To stay up to date on sustainability disclosures across your industry and compare your targets, risks, and opportunities, you can use Datamaran for Peer Benchmarking. Want to see how we can help you validate and spot gaps in your ESG strategies? Book a demo.

*The “sustainability reporting” we analyzed includes annual corporate reports that substantively address environmental, social & governance information.