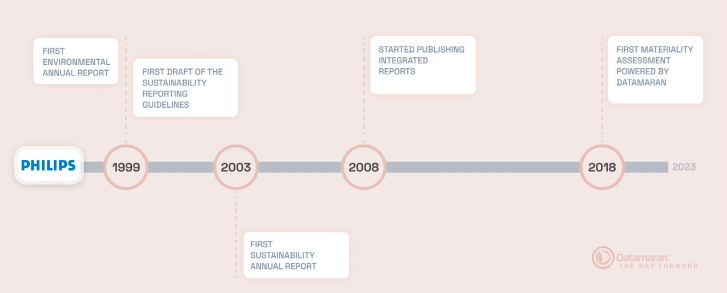

For Philips, it was a given that its sustainability efforts should be externally assured because the credibility of its data is essential. Simon Braaksma, Senior Director of Corporate Sustainability, says that the company has been committed to sustainability for many years and that part of this commitment is to provide data in a way that stakeholders can trust.

Core to this approach is that sustainability is not an add-on to their business: it is fully integrated. To achieve that, their approach to financial and non-financial data needed to be aligned. For Braaksma, it is important that stakeholders find the company’s non-financial disclosures as trustworthy as its financial data, meaning that reasonable assurance on all data, including the materiality analysis results, needs to be obtained. Auditors were presented with the materiality analysis process and raw data to understand how material topics were determined using Datamaran.

The value of reasonable assurance when compared to limited assurance is implicit in the language used by auditors. In limited assurance, the auditor’s conclusion takes the form of a non-committal, almost defensive statement such as: “Nothing has come to our attention that causes us to believe that the report is not fairly stated.” In reasonable assurance, the conclusion is expressed in a more affirmative fashion: “In our opinion, this report in all material respects is fairly stated.”

In a constantly evolving regulatory landscape, Braaksma believes that obtaining reasonable assurance now will help prepare the company for the implementation of the new EFRAG European Sustainability Reporting Standards (ESRSs): “for many years, we had anticipated that assurance for ESG would transition into the regulatory space,” he says “, as such we’re well prepared - let them come, we are at that stage already.”

Furthermore, through Datamaran’s double materiality capabilities, Philips are able to address another mandatory requirement of the ESRSs.

From 2024 onwards, the ESRSs will mean it is mandatory for many European companies and certain non-European companies to obtain limited assurance over ESG disclosures, which must include a double materiality assessment. The ambition of EFRAG is to move to reasonable assurance at a future date.