8 min read

How to focus on the right material ESG issues for your business

6 min read

Identifying the issues your stakeholders demand

The vast amount of ESG data, issues and challenges can be bewildering for companies just starting on their ESG journey. But it needn’t be that way. The most sage advice comes from Sandy Nessing, Chief Sustainability Officer at AEP: “don’t try to boil the ocean”.

It is an important point to remember, especially during challenging economic times. Make sure the focus is on the things that are most important to your business and stakeholders - and do those well. It sounds obvious but it is surprising how many leaders either try to do too much and fail, or feel scared of starting because it looks too daunting and miss out on the opportunities.

Consultants will take you through a costly and time consuming manual process of identifying where the focus should be, which can be helpful, but not always based on rigorous data. By building in efficiencies at this stage, relying on data-driven insight and taking advantage of technology, the issues mapping process is a valuable and strategic investment that pays dividends. Don’t take our word for it, it’s enshrined in the new legislation coming from EFRAG in Europe and the SEC in the US.

Benchmarking against peers

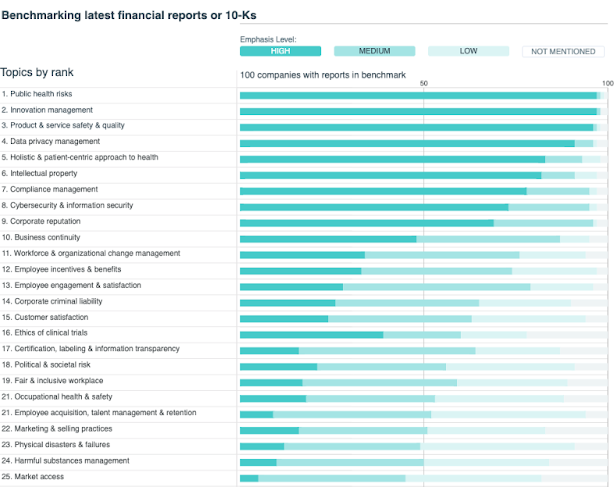

The most sensible starting point to identify the issues your organization should focus on is to benchmark against peers. Technology is by far the most efficient way to do this. AI helps quickly understand how your organization compares with others within your sector.

The Datamaran approach, which uses the SASB framework, measures the frequency and emphasis of a selection of 100 different ESG topics, which are in turn made up of more than 400 different ESG factors. These topics can be further grouped into six categories, like environment, governance, etc. to further simplify and focus efforts.

| Example ESG Topic |

ESG Factors |

| GHG emissions & reductions |

Refers to the direct and indirect emissions of greenhouse gasses (GHGs) and emission reduction targets aimed at limiting individual company contributions to global warming. The following factors are covered:

|

| Political & societal risk |

Refers to economic, political and societal pressures that may pose risks to business if not handled appropriately by national or subnational governments or agencies. The following factors are covered:

|

A benchmarking process should reveal how many companies place different levels of emphasis (High, Medium, Low, or No Mention) on ESG topics disclosed in corporate reports.

With visibility of the topics covered most by your peers in their financial or sustainability report, the strategic choice is whether to follow the most frequently covered topics, or set a new example based on your own unique stakeholder profiles.

.png?width=614&height=381&name=unnamed%20(13).png)

Identifying trends

Reviewing the top trends helps choose which topics to add or remove to stay ahead of the curve while also remaining laser-focused on the issues that are most relevant for you and use resources wisely.

.png?width=574&height=328&name=unnamed%20(14).png)

Stakeholder insight

Perhaps the most valuable of all insights is to understand what stakeholders consider material. Reviewing which topics are being discussed in the media or are subject to the most recent regulatory change, all give a good idea of the topics and issues that are most important. But the final and most important way of understanding what stakeholders want is to ask them.

Conducting a stakeholder survey and combining the data with these other insights give the best indication of where time and effort should be directed. Employees and customers will have specific demands, leaders and the board of directors will have their own expectations, but suppliers and investors will also be important audiences. Each audience’s opinions might need to be weighted differently in the wider context, but their voices are all important in this process.

Advice from the experts

Veterans of this process would suggest to start small, focus on the issues that pose the greatest business risk. That’s all that is expected. Identify the voluntary rules and regulations, focus on the related issues and then build on this over time as you become more proficient and see where more value lies. Focus on protecting your license to operate and staying ahead of your stakeholder expectations.

Regulatory organizations that are leading the charge in Europe and the US both recognize the role that technology, and specifically Datamaran, must play as ESG becomes more complex.

As Giulia Genuardi, an EFRAG TAG member recently stated: “Datamaran is absolutely an input of this kind of process because we can gather a lot of information for the impact and for the priority of the company. But especially for the part of impact we have to involve all the departments of the company because if we wanted to correctly define the action plan, we have to measure all together this kind of impact.”

It’s the only way to ensure all the risks are evaluated effectively. It is no longer realistic for individuals, or even sometimes teams, to manually review and consider all the moving parts. With technology, non-experts and individuals punch above their weight.

Continue the series to find out how you can use data to scan the horizon and make strategic ESG predictions to stay ahead of the ESG regulatory curve.