6 min read

How often do you need to review ESG - and who’s responsible?

11 min read

With issues and stakeholders evolving fast, what is best practice?

Anyone that has been involved in a manual materiality or double materiality assessment understands the time, effort and financial investment needed. Doing this annually would be impossible for most organizations. But in the increasingly dynamic ESG space, with its greater scrutiny, arguably it’s the least you should do to stay on top of developments and avoid the limitations of a “time-skewed snapshot”. There is another option.

Regulators are more interested in whether companies are living up to their promises. They are taking action when these targets are not achieved, so having an early warning mechanism is a useful hygiene factor. Undertaking this process more frequently can also offer greater strategic opportunities, but it comes with challenges. Developing an approach that responds to the rapidly changing business environment calls for new ways of thinking.

The traditional two-year audits were onerous, even for a team of ESG specialists, often requiring expensive advisors. Thankfully, doubling the frequency does not mean doubling the investment or recruitment, just making the most of the latest innovation.

Is an annual assessment enough?

Once the parameters are set, businesses typically benefit most from full annual assessments, quarterly pulse checks and even more frequent monitoring. Being fully informed, allowing you to be both proactive and reactive, is the best way to transform ESG from an expensive compliance driven activity into a strategic tool that delivers opportunities. Fundamental to this thinking is the notion that getting information too late to act upon is the biggest waste of investment and opportunity. Right now is the norm.

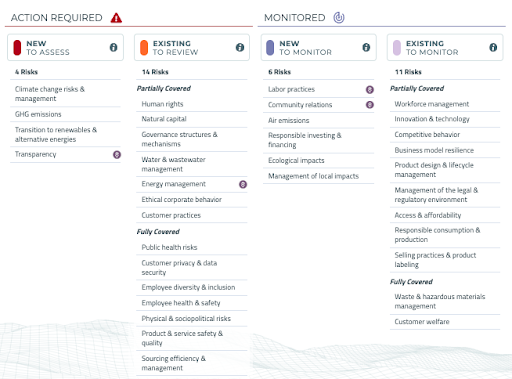

A full annual review means any strategic decisions can be made from a position of knowledge. The outcomes of stakeholder demands, peer benchmarking as well as medium and long term regulatory predictions will influence how the business prepares for the year ahead. Timely action can be taken on the most imminent risks - the table above highlights how a CEO of a fashion retail business can see the issues facing companies in their sector.

But in the months between these reviews much can change, a lot of ground can be lost and opportunities missed. Four elements in the dashboard above for example - transparency, energy management, labor practices and community relations - have seen a significant change in risk profile within the last three months, highlighted in the table below to be as a result of a raft of proposed mandatory regulations on transparency.

.png?width=655&height=174&name=unnamed%20(10).png)

Advantages of quarterly pulse checks

The ESG landscape is changing faster than ever, so quarterly pulse checks are always revealing for business decision makers. It can take just days for the environment to change, whether from regulations or wider public debate. Seeing at the highest level how things are evolving at the touch of a button (or even with an automated process), and in such high fidelity if necessary, is both reassuring and empowering for business leaders.

.png?width=655&height=174&name=unnamed%20(10).png)

Compare this to the processes that might be familiar to some - full assessments every two to five years and annual ‘light’ reviews, relying on ESG, risk and legal professionals within the business to stay abreast of any developments as part of their day to day role.

Not all the information coming from continued monitoring requires decisive action or a shift in strategy. But thanks to this advance in ESG technology the destiny of organizations in the face of accelerating changes in sustainability and social laws and expectations is in their own hands.

New ESG review schedules enabled by technology

A fast changing and dynamic ESG environment could be seen as a problem, or it could be embraced as an opportunity to stand out with stakeholders. To make the most of this opportunity a process has to be manageable, scalable and deliver value. Here is an example of the processes some companies undertake.

| 12 months |

6 months |

3 & 9 months |

Monthly/Weekly |

| Materiality assessment |

Materiality Assessment ‘light’ |

Quarterly Pulse Check |

Regular Monitoring |

|

|

|

|

The secret to managing and mobilizing ESG as a strategic tool is good quality data - delivered regularly and focused on the areas that make the biggest impact for stakeholders. Reviewing this on an annual basis is the minimum requirement as the field of ESG develops rapidly. A quarterly pulse check gives an important early warning system and allows a dynamic response to a dynamic environment. This will soon be the new normal.

But as technology is the only way to filter, manage and present this level of data insight, it allows the bar to be raised further. If ESG is an important influencer for your stakeholders, and all the evidence suggests this is becoming more common, there is scope to do more. It is now realistic from a financial and time resource perspective to have an up-to-date situation report that is high quality on demand. Decision-useful ESG insight at the touch of a button.

Who is responsible for ESG?

As ESG becomes mainstream it is not just the most progressive companies that are elevating it to the most senior levels of the business. But with so many companies doing this for the first time, many are looking for the most effective structure.

There is consensus that the ultimate responsibility for ESG lies within the C-suite. After all, used correctly it has such strategic importance for sales, people, reputation and as a funding tool. But with so many relevant skills in the C-suite, is it better to share responsibility?

What’s the right model for you? Does ultimate responsibility lie with the CEO, CFO, Chief Risk Officer or General Counsel? Here are some examples of how companies we work with operate.

.png?width=627&height=435&name=unnamed%20(12).png)

CEO - Integrating with strategy from the top

As the person ultimately responsible for the business, ensuring ESG is integrated into the vision, mission and strategic decision-making process is the CEO’s role.

But this strategy doesn’t appear out of thin air. It is a balance of multiple factors, and one of the crucial elements is the influence of the various stakeholders. The issues most important to them are increasingly being driven by ESG factors, so these factors influence the business strategy.

With so many competing needs, getting accurate and verifiable high-level data and insights to inform the strategy and help monitor and measure its success is key. This encourages buy-in from the board, finance and legal functions – having the facts to back up strategic ESG decision-making and demonstrate progress is now an essential part of the integration process.

ESG Responsibilities:

-

Setting the strategy with ESG fully integrated and all stakeholders taken into account

-

Staying ahead of the performance of the business against ESG goals and objectives

-

Deploying resources in the most efficient way possible to achieve these goals

-

Mobilizing and inspiring the business to align with, and drive towards, ESG targets

-

Choosing ESG as a focus now could be an inspired move as more employees, customers, investors and regulators are moving further in this direction

CFO - Making the ESG vision deliverable

CFO opinions on ESG are changing fast. The question used to be “why should I be interested in ESG?”; more recently it’s “ESG is now falling into my remit, how do I get up to speed fast?”.

A challenge for a CFO is whether ESG can be integrated into financial reporting with the same level of rigor as revenue or assets. This helps make ESG accountable and plays into the skillset of a CFO.

While various ESG frameworks and standards can do this, the challenge is to understand which are the ones most relevant to your business goals and how to deliver against them. But don’t get caught up on reporting perfection. The critical thing is to develop an authentic ESG voice and make a start rather than wait for the perfect way to report its progress.

This CFO brings reality to the ambitions and vision of the CEO, so it is important to have a good understanding of what you are as a business, what you are capable of and the capacity to hire the skills to deliver on those ESG promises.

ESG Responsibilities:

-

Ensuring the CEO vision for ESG is deliverable and measurable

-

Integrating ESG into the financial reporting structure of the business

-

Ensuring the correct metrics are in place from the standards and frameworks available

-

Monitoring and ensuring delivery against the targets, avoiding greenwashing

Chief Risk Officer/General counsel - Ensuring compliance

As ESG expectations from stakeholders rise, so too do the related risks. With the C-suite becoming more involved, legal and risk professionals are drawn further into the ESG discussion. Whether regulatory, reputational or financial, the CRO and/or General Counsel must estimate, measure and mitigate this risk.

Navigating this complex maze of risks can be time-consuming, so identifying the most relevant risks in the long, medium and short term is essential. Visibility of how the regulatory landscape and public opinion is changing helps focus on what you should try to influence.

There is an increasing opportunity to build a competitive advantage from a better understanding of the intersection between ESG and the law. But, to marry the most relevant ESG material risks and opportunities with the risk management process, a CRO needs reliable and dynamic data.

ESG Responsibilities:

-

Understanding the regulatory, reputational and financial ESG risks specific to your business, whether long, medium or short-term

-

Plotting ESG issues on the risk map or register

-

Monitoring and ensuring progress

-

Making sure what you say about your ESG strategy, progress or metrics is accurate

Chief Sustainability Officer - Cross-functional collaboration

Though strategy is set from the top, ensuring these goals are achieved cascades through the entire workforce.

Chief silo breakers are the Chief Sustainability Officer and the ESG specialist team. Their role is embedding ESG into the DNA of the business, bringing teams together.

All this is achieved by building consensus or developing working groups and cross-functional teams to oversee ESG to validate what is being seen across the business. One of the most important roles is ensuring everything is on-track and highlighting issues early.

Recruiting these skills is difficult and a team of ESG specialists is becoming impossible. You can attract these specialists with a progressive technology-led approach to ESG. You can also help them achieve more by giving them the most innovative tools, allowing smaller teams to deliver more.

This collaborative effort is typically reported to an ESG or Sustainability Committee, Risk Committee and the board of directors.

The roles our clients involve in cross-functional ESG teams:

-

Legal from a governance perspective

-

Chief Risk Officer

-

Deputy Treasurer

-

Environmental Services

-

Climate Team

-

Chief Diversity Officer

-

Corporate Communications

-

Investor Relations

-

Corporate Sustainability

-

The ESG specialist or team is the essential conduit through which initiatives are cascaded and valuable feedback on progress is collated

This shared approach is being deployed by the companies taking the most progressive approach to ESG. However, this is just the tip of the iceberg. Strategy and culture comes from the top, but flows throughout the business.

The ultimate challenge is not only to ensure the C-suite are familiar with their ESG roles and responsibilities, but that every employee and supplier understand their role in delivering success. Get to grips with building an effective ESG governance.