6 min read

CSRD Compliance: A Race Against Time

8 min read

The Corporate Sustainability Reporting Directive (CSRD) is driving a significant change in sustainability reporting requirements. Passed by the European Parliament, it establishes the European Sustainability Reporting Standards (ESRS) that will be adopted by around 50,000 EU-based companies. Compliance with the CSRD requires treating sustainability information with the same rigor and accountability as financial data. The directive aims to harmonize sustainability disclosures, enhance transparency, and promote a holistic understanding of a company's impacts on the environment, society, and stakeholders.

To meet CSRD requirements, organizations need to optimize collaboration between finance, sustainability and risk teams, combined with C-suite reporting. Effective compliance necessitates robust data management and technology capabilities. Assessing a company’s existing ESG tech stack, in a similar manner to finance tech stacks, can ensure integration of teams and processes, and manage workload efficiently. The deadline for CSRD reporting is rapidly approaching, highlighting the urgency for companies to prepare, embrace sustainability practices, and stand out in the market. This blog will guide you through the steps to prepare for compliance and leverage technology effectively.

Watch the on-demand webinar "CSRD Compliance: A Race Against Time" with insights from Boeing, Dell, and Philips International.

What is CSRD trying to achieve?

The Corporate Sustainability Reporting Directive (CSRD) is reshaping the ESG landscape, demanding stricter disclosures from large corporations.

CSRD, part of the EU's sustainable finance agenda, raises the bar for sustainability reporting. It harmonizes standards, ensuring consistent and comparable ESG disclosures across the EU. Embracing this transformative shift is not just a regulatory obligation; it's a strategic imperative that can amplify your sustainability efforts and help competitive differentiation.

CSRD compliance is essential. It showcases your commitment to sustainability, builds trust with stakeholders, and attracts responsible investment. CSRD enhances reporting obligations and raises standards for transparency and accountability. It aims to standardize ESG disclosures across the EU, empowering stakeholders to make better-informed decisions.

CSRD introduces a "double materiality" approach, demanding reporting on how their business activities impact the world around them, as well as the financial implications of sustainability issues on their business.

CSRD demands a forward-looking perspective. Your sustainability plans, targets, and progress toward those targets must be disclosed. Businesses will have to showcase their commitment not only to the environment, but also to human rights, and ethical business practices.

Compliance with CSRD is not just about ticking boxes; it's about gaining a competitive edge. By meeting the requirements, you demonstrate your dedication to sustainable practices, building trust with investors, customers, and stakeholders.

The opportunity to establish integrated reporting practices that guarantee data integrity, foster trust throughout the process, and reduce risk remains, but time is running out.

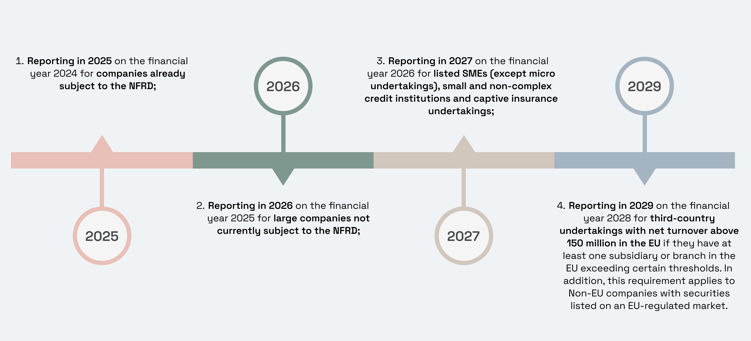

CSRD Timeline

Under the CSRD, companies must use the European Sustainability Reporting Standards (ESRS), which are developed by EFRAG, an independent body of stakeholders. These standards will align with EU policies and contribute to global standardization efforts.

With only 6 months to go, companies need to start getting ready for CSRD now to ensure they can comply with the new regulations when they come into effect.

Starting in 2023, eligible organizations must prepare for the CSRD by building ESG reporting capabilities and infrastructure. The CSRD takes effect for these organizations in their corporate fiscal year 2024.

In 2025, qualifying large businesses must disclose a CSRD report based on the first set of sustainability reporting standards for their 2024 financial year. All EU Member States must comply with the CSRD by July 6, 2024. CSRD Article 4 of the Directive applies from January 1, 2024, for financial years starting on or after that date.

What companies are impacted by CSRD?

The impact is already being felt worldwide, from financial markets to investor expectations.

The Corporate Sustainability Reporting Directive (CSRD) will apply to at least 10,000 companies outside the EU, with about one-third of those in the U.S.

Businesses operating outside the European Union (EU) must adhere to the following regulations if they meet any of the following criteria:

- They have securities listed on a regulated market within the EU.

- They possess an EU branch generating a net revenue surpassing €40 million and an annual EU revenue greater than €150 million.

- They own an EU subsidiary categorized as a large company, consisting of more than 250 employees based in the EU, a balance sheet exceeding €20 million, or local revenue surpassing €40 million

Analysis shows there are 10,400 foreign companies listed on EU stock exchanges. Furthermore, there are over 100 non-EU companies with local revenue exceeding €150 million. The breakdown of these companies is as follows:

- 31% are of American origin

- 13% are of Canadian origin

- 11% are of British origin

What do you need to do for CSRD?

Companies are underestimating the upcoming workload.

CSRD arrived at a challenging time for most large companies, reporting teams in particular. Typically, disclosure reporting is integrated with financial reporting and coordinated by the CFO, and CSO, and signed off by the CEO. The majority of businesses have small ESG or sustainability teams and with finance teams facing an ever-increasing workload, data quality is one of the biggest issues requiring attention.

Companies are increasingly tasking CFOs with various responsibilities that support their sustainability goals. This widening of their remit includes a singular emphasis on measuring, managing, and reporting traditional elements of financial value.

Reporting teams are reaching or exceeding their capacity, and they will face additional workload pressure due to new CSRD reporting requirements, such as increased disclosure, auditor assurance, and XBRL tagging. To address these challenges, companies may need to adopt new technology solutions.

As companies rely increasingly on data to drive reporting and performance, the risks of misreporting due to poor data have become critical.

CSRD reporting is predicated on robust data and there are significant risks if not derived from consistent and reliable data. Unfortunately, maintaining clean and consistent data poses a tough challenge for companies, as raw data is often messy and requires significant effort to manage effectively.

Now is the time for companies to assess their current tech stack and ask tough questions such as whether they will be able to manage more data, whether they trust both their financial and sustainability information, how integrated their teams, data, and processes are, and whether they are confident that their teams won’t burn out under the additional workload.

CSRD and Double Materiality

For companies impacted by CSRD, it is mandatory to conduct a double materiality assessment.

Double materiality is a concept that recognizes the dual impacts of environmental, social, and governance (ESG) factors on both financial performance and broader societal and environmental concerns. It highlights the interdependent relationship between the financial performance of a company and its impacts on the environment, society, and stakeholders, as well as the potential impacts of external ESG factors on the financial performance of the company.

Conducting a double materiality assessment involves evaluating and analyzing the financial and non-financial impacts of a company's activities on both the organization itself and external stakeholders. Here are the general steps involved in conducting a double materiality assessment:

- Identify material ESG factors: Begin by identifying the ESG factors that are most relevant and impactful to the company and its stakeholders. This involves considering a wide range of environmental, social, and governance issues, such as climate change, labor practices, supply chain management, community engagement, and board diversity.

- Assess financial materiality: Evaluate the financial risks and opportunities associated with the identified ESG factors. Consider how these factors could affect the company's financial performance, including revenue, costs, profitability, and long-term value creation. This assessment involves analyzing financial data, conducting scenario analysis, and considering market trends and investor expectations.

- Assess extra-financial materiality: Evaluate the broader societal and environmental impacts of the identified ESG factors. This involves assessing the potential positive or negative effects on stakeholders, such as employees, customers, communities, and the environment. Consideration should be given to potential reputational risks, regulatory compliance, stakeholder expectations, and alignment with sustainable development goals.

- Prioritize and disclose: Prioritize the material ESG factors based on their significance and impact on both financial and extra-financial aspects. Prepare transparent and comprehensive disclosures that communicate the identified material ESG factors, their associated risks and opportunities, and the company's strategies, targets, and performance in managing them. This disclosure can be in the form of sustainability reports, integrated reports, or other relevant reporting frameworks.

- Monitor and update: Continuously monitor and reassess the materiality of ESG factors as the business landscape evolves. Stay updated on emerging issues, changing stakeholder expectations, and regulatory developments. Regularly review and refine the double materiality assessment process to ensure it remains aligned with the company's goals, stakeholder interests, and evolving reporting requirements.

CSRD Requires Independent Auditing

As previously mentioned, data quality can be an issue in reporting. Sustainability information published by companies often falls short in terms of completeness, reliability, transparency, and accessibility. Important details are often missing, making it challenging to find, read, and compare the information.

To enhance the quality of sustainability information and bring it on par with financial reporting, an external auditor will be required to provide assurance on both aspects following the implementation of the CSRD. Initially, this assurance will be of a "limited" nature, but by 2030, it will transition to a "reasonable assurance" standard.

Early engagement with auditors will help to address any challenges or questions, ensuring clarity and evidence in the approach. Datamaran clients have already achieved reasonable assurance, exceeding the immediate CSRD requirements.

How can Datamaran help with CSRD?

There is a collaborative relationship between finance and sustainability professionals within many organizations, whilst this may not be fully optimized it needs to be built on foundations of robust data.

With reporting due to start in less than 6 months a sense of urgency is developing to meet the compliance requirements of the CSRD.

Datamaran can help companies comply with the CSRD by providing the underlying evidence driving the material issues identified, enabling credible and defensible decision-making. Additionally, Datamaran can help companies develop robust organizational structures and soft systems to deliver ESG best practices, including governance infrastructure and oversight.