7 min read

ESG: the journey from best guess to best informed

8 min read

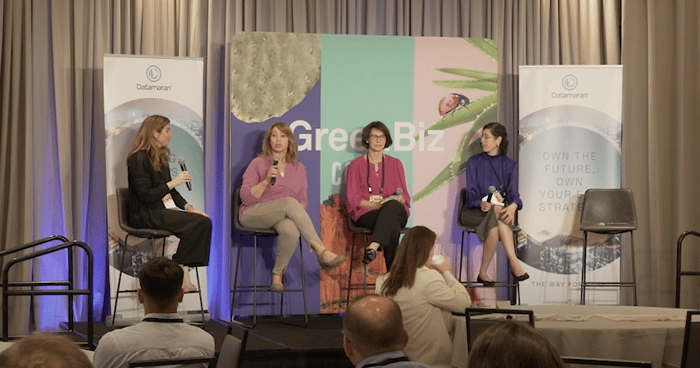

Datamaran’s C-Suite Forum at GreenBiz23 explored the role of technology and data in the evolving ESG landscape during the second-panel session.

Moderated by Sarah Zaman, General Council and Head of ESG Academy at Datamaran, speakers at the session were Victoria Emerick, Executive Director and Global Head of Corporate Sustainability Strategy and Operations at Bristol Myers Squibb, Karen Beadle, VP ESG, Marathon Petroleum, and Megan Maltenfort, VP ESG, Cardinal Health.

The panel tackled the challenge of “Transitioning from best-guess ESG to best-informed ESG” to support business strategy and executive leadership.

Datamaran’s C-Suite forum provided the first chapter of the ESG tech story from a business perspective with several themes emerging from the panel discussion which can be viewed here.

"The ability to use technology, and data in particular, has really elevated the conversation that we've been able to have with our leadership teams and has made them take us seriously."

Making the complex understandable

ESG is a complex area and relationships between data points are not always obvious, providing a metric that people can understand is key to success.

Victoria Emerick, at Bristol Myers Squibb, was interested in GHG emissions and the relationship between climate and human health. Aligning those issues with the concerns of BMS’s scientists, commercial teams, and executive leadership was achieved through materiality analysis.

With billion-dollar drugs for lung cancer and cardiovascular disease on the market and 8 million people dying from GHG-related emissions, she was able to connect BMS’s purpose to the company mission as well as the company strategy and values. Rather than report on CO2, per unit mass, which would have little relevance internally, the data was broken into activity metrics that have an impact that can be audited.

Technology can take complex data points and translate that into metrics people elsewhere in your business can understand and relate to, helping them make informed decisions.

You can’t prioritize everything in ESG

Unearthing multiple ESG issues is common and prioritizing which are most important is key. In many ways deciding what you’re not doing is harder and more important than deciding what you are doing. Objective insights and benchmarking help identify areas where organizations could be leading or could be lagging.

Data gathering and reporting can be a huge drain on internal resources as ESG professionals focus on different issue areas. Using technology to expedite the data gathering and decide which ESG areas are material helps inform executive leaders to make data-driven decisions on what to accelerate and prioritize everything under the ESG umbrella.

“Datamaran has already paid dividends in terms of helping us to provide data to support some decisions, for example, a biodiversity target that we didn't have previously.”

The days of sustainability professionals being viewed as “tree huggers” are long gone. Sustainability and ESG professionals are now empowering leadership teams to think critically about ESG risks and how they intersect with business risks. Until recent developments in the ESG tech stack and data gathering this hadn’t been a realistic possibility.

Meeting the data needs of the C-suite

The change in the conversation between ESG and sustainability executives and C-suite is neatly illustrated with an example shared by Megan Moltenfort. Cardinal Health published its most recent ESG report in January with details of an 18% reduction in greenhouse gas emissions, cause for applause. The applause was swiftly followed by the CEO asking “How did we do that?”.

10 years ago any company that reduced greenhouse gasses would have wanted to share the information with customers and use it as a “good news“ marketing story - today’s executives want to know the detail of what drives that reduction, and how it is being tracked in order to explain to their boards of directors.

Executive reporting will continue to grow in importance with the increase in accountability driven by evolving legislation. The tech stacks and resulting data used by ESG specialists will become critical business tools as they are integrated into wider company infrastructure.

The right technology lets the C-suite tell its ESG story effectively to all the organization's stakeholders.

“We saved over 75% of the projected costs that a traditional materiality assessment would have cost us, and we gathered better information to drive data-driven decision-making.”

What does ROI mean?

ROI as return on investment is well understood and is commonly discussed when setting budgets. There is another meaning that is particularly important when discussing ESG; ‘Risk Of Inaction’.

A key element of any ESG or sustainability officer's role is assessing not just current legislation but emerging legislation. Using the ESG tech stack to investigate and prepare for emerging soft law, emerging hard law, ESG trends, and what is driving those trends can aid capital investment requests as they are now part of a business resilience conversation with board directors.

Victoria Emerick suggests the risk of inaction can be quantified, estimating costs can be between 10 and 50-fold more to course correct. Investment in the ESG tech stack is now being framed as a cost-saving exercise as business leaders navigate the headwinds and understand how ESG is a tool to address those challenges.

ESG is potentially the number one driver of change over the next 10 years, and the ESG tech stack has the capability to deliver quick, data-driven decisions and issue prioritization.

Leapfrog to the ESG tech future

The panel offered key takeaways and action points, advising sustainability professionals to:

- Identify the problem you are trying to solve

- Plot where you are today

- Establish what good looks like

- Reverse engineer back to where you want to be

ESG and sustainability professionals now have the skills to achieve this because software providers have built the tech stack with your issues in mind.

The final tip which highlights the extent of the technological advances, and what that means for those that have worked in this space for many years, Karen Beadle added - “If you don’t have 5 - 10 years' worth of spreadsheets then leapfrog and find the right technologies now”.