5 min read

Six things you should know about EFRAG: Be regulatory ready

8 min read

Companies worldwide are being asked by regulators and investors to demonstrate that the executive leadership has oversight on sustainability impacts, risks and opportunities - and acts accordingly. This is not an easy task. The European Commission is aiming at standardizing this process and ensuring it is transparent through the new EU Sustainability Reporting Standards (ESRS) developed by the European Financial Reporting Advisory Group (EFRAG).

The ESRS are the mandatory standard to report against under the recently adopted Corporate Sustainability Reporting Directive (CSRD). The first batch of companies will be required to apply the ESRS as early as fiscal year 2024, for the reports to be published in 2025.

EFRAG and CSRD put the EU at the forefront of the global movement to ensure investors, financial markets, governments, decision makers, customers and society at large have access to reliable and material ESG information. This is imperative to make informed decisions and help the transition to a sustainable economy. The new rules are aimed at over 50,000 EU companies and will also apply to non-EU companies with presence in EU member states, provided they meet certain criteria (more on that below).

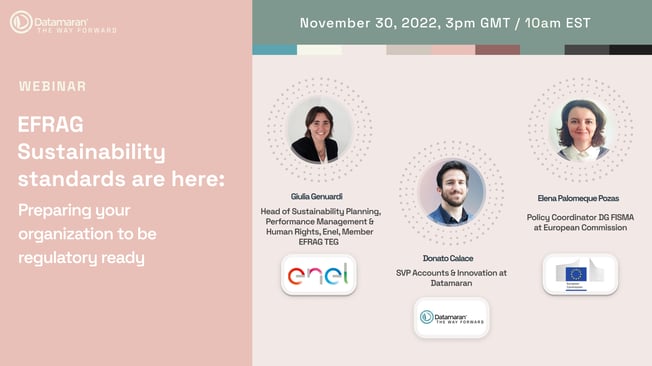

As the regulatory pressure increases rapidly, companies are scrambling to familiarize themselves with the new requirements and get ready for the new rules. We recently discussed the implications for companies in our “EFRAG Sustainability Standards are here: preparing your organization to be regulatory ready" webinar.

During the discussion, Giulia Genuardi (Head of Sustainability Planning, Performance Management & Human Rights at Enel and EFRAG TEG Member) and Elena Palomeque Pozas (Policy Coordinator at DG FISMA), clearly defined how companies should prepare to make ESRS-compliant disclosures.

1. Governance and management oversight must change

The imminent enforcement of the new EU Corporate Sustainability Reporting Directive (CSRD) requires more than 50,000 companies to report on their sustainability impacts, risks and opportunities by 2024 - according to the new EFRAG ESRS. This will pile pressure on organizations to streamline and professionalize their ESG strategy, governance and data at speed.

As Genuardi pointed out, there are three different factors when considering the Board's role in management oversight.

“The first part is related to the composition of the board, because they need to consider a specific sustainability element.

The second part is really important because it’s related to the analysis of the sustainability matters by the board member of the committee in relation to the structure of the company. It's absolutely important that they analyze sustainability matters, that they analyze the risks and opportunities related to sustainability. Some companies have this kind of approach, but others do not.”

The responsibility of overseeing external ESG risks does not solely lie on the shoulders of Boards. Instead, it’s the result of a multi-step process managed by executive teams and enabled in different ways within companies. The ultimate goal is to provide Board members with good quality data that allows data-driven strategic decisions on current and emerging risks.

“The last element that we have to consider is remuneration policy,” continued Genuardi. “If you have defined a specific structure in terms of sustainability, you have also to integrate this kind of target and this kind of challenge inside the remuneration policy of your management”.

Given these requirements, the standards are not just expecting transparency from companies, but a reconfiguration of the ESG governance process, which must be brought to an integrated level to better adapt to our new and changing reality.

2. Get ready for double materiality assessments

Under the CSRD, subject companies must report according to a “double materiality” perspective, in which they must consider not just the material impacts of ESG factors to the organization but also the organization’s own impacts on the environment and social systems.

“I am really convinced that the merge of these two views can allow us to have all the information that we need to define sustainability strategy and sustainability reporting. Using the first one [single materiality], you really understand the priority of your account, the priority of your stakeholder and the alignment in respect to the strategy of the company. Through the second one [double materiality], you can measure exactly the impact generated and the impact suffered”.

Before you get started: the whole materiality process is, in its essence, a governance process. For this reason, if not already existing, create a governance body to ensure appropriate management of material issues identified. How can companies get started? Determining the materiality of ESG and financial impacts of a company is done through the following 5-step process:

1. Identification through collection of data across multiple sources

2. Assessment through gathering of evidence demonstrating impact and financial materiality

3. Engagement with internal and external stakeholders, including the board and the executive level

4. Reporting & Audit to document and review the process and results

5. Monitoring the evolution of material issues in a dynamic way

Identifying and monitoring ESG risks is not possible without a solid process and the right ESG solution. This is why it’s essential that information on material ESG risks and opportunities is rigorous and supported by traceable data, making sense of the plethora of information out there.

“Datamaran is absolutely an input of this kind of process because we can gather a lot of information for the impact and for the priority of the company. But especially for the part of impact we have to involve all the departments of the company because if we wanted to correctly define the action plan, we have to measure all together this kind of impact.” Genuardi outlined how Datamaran allows companies to use data-driven insights to create an agile and integrated business and ESG strategy.

What’s next? “A personal suggestion is that in the future, we will have to define a taxonomy of the impact, to ensure a consistent and comparable approach. In a practical way, in Enel we will use the ISSB for the financial materiality and the GRI for the impact of materiality”, Genuardi continued.

3. Resourcing - prepare now or get caught short later

It’s critical to dedicate sufficient resources to offering an ESG strategy. Getting the funding, tools, resources and talents you need can be a long process; it’s essential to start securing it early.

On this note, the CSRD will ask all companies to have limited assurance for the first step and reasonable assurance for the second step and it’s important to think on the implementation costs.

“In the future, there will be a great benefit, regardless of the cost. But it's absolutely true that in the short term, we’ll have an increasing cost in terms of resources, in terms of digitalization and in terms of assurance. Especially because we need time to implement and we need new resources to do that,” stated Genuardi.

With the ESG agenda now deeply embedded in future business and economic strategies, the competition for talent within ESG and the broader sustainability community presents a growing concern for the development of climate and sustainability solutions. Because this field is new, the pool of people with these skills and experience is small. “The major thing that I am really scared about in terms of sustainability is the lack of skill set,” Genuardi said.

For this reason, finding the right ESG technology to execute on your objectives is crucial. With the volume of data that digital technologies can process at rapid speed, ESG leaders can make intelligent, evidence-based decisions more rapidly, with less staff overhead.

4. EFRAG will impact many non-EU companies

As mentioned before, even if your business is not based in the EU, CSRD will apply to certain non-EU companies and its requirements will impact your business if it is part of the value chain of an entity that is required to report. So what should non-EU companies know about the new EFRAG standards?

First, the CSRD will also apply to companies with securities listed on an EU-regulated market, irrespective of whether the issuer is established in the EU or a non-EU country. This includes listed small and medium-size enterprises (SMEs), except for certain listed micro-enterprises.

Companies will be required to apply the full ESRS and report about their material sustainability risks and impacts related to its activity and to the value chain. “The CSRD does not distinguish between impacts and risks that happen in the EU and impacts and risks that are generated outside the EU. In this respect, the CSRD introduced certain flexibility for the reporting of information related to the value chain during the first three years of the reporting,” Palomeque clarifies.

From financial year 2028, if a non-EU company generates more than 150 million in the EU and has branches that generate in the EU more than 40 million euros; or has an EU subsidiary that fall under the scope of the CSRD. That branch of the subsidiary must prepare a sustainability report at the level of the non-EU company. In this case, the Commission will adopt separate sustainability reporting for these companies that will focus only on impact, not on risk.

Finally, when a non-EU parent of a non-EU subsidiary that falls under the scope of the CSRD chooses to report on a consolidated basis for the group as a whole.

5. You have to get started now

That gap between companies’ intentions and actions on ESG issues stems from difficulties quantifying the efficacy of ESG initiatives and determining which of the many issues that fall under the broad ESG umbrella are relevant to them.

Transparency and accountability also present major challenges, particularly as regulatory agencies like the SEC consider new rules that would require companies to disclose climate change risks associated with their operations.

Regardless of how companies choose to approach ESG, the best time to start is now. Companies that attempt to map the entire route toward net-zero emissions before setting out on the journey risk never setting out at all. And they get left behind in the process.

“Our advice is to start to proceed with the draft standard that is publicly available; that will provide a good insight on the final requirements of the CSRD,” said Palomeque. CSRD and ESRS will require companies to have in place systems and procedures to identify, assess and enable executive management and Board oversight on ESG impacts, risks and opportunities.

To ensure that in-scope companies are prepared to make ESRS-compliant disclosures, their ESG leaders should be thinking about the effects that the ESRS may have on the company’s processes and systems of internal controls - as well as their ability to gather relevant information.

6. There are consequences to not reporting

What happens if a company doesn't report or doesn't report well enough? Will companies be sanctioned? “On the enforcement of sustainability reporting, the Member States’ National Competent Authorities are responsible for the enforcement of sustainability reporting. And in this respect, their transparency directive specifies a minimum set of administrative measures and sanctions in case a company infringes on the reporting financial reporting obligations.

In addition, ESMA, the European supervisory market authority, will play a role in promoting enforcement practices and ESMA may issue voluntary guidelines for the National Competent Authorities,” Palomenque outlined.

How Datamaran can help

Datamaran provides the C-suite infrastructure for ESG decision-making that is demanded in new rules and standards such as the CSRD and the ESRS.

Implementing a scalable and repeatable process with technology at its heart is critical to be both efficient and consistent. Datamaran is the only solution in the market that builds an ESG infrastructure to help deliver your strategy.