5 min read

Transforming Double Materiality with AI-Powered Insights

4 min read

Following continued investment and innovation, Datamaran has enhanced its already industry-leading double materiality assessment and introduced the first-ever AI-powered double materiality assessment solution. This latest innovation from Datamaran’s Smart ESG platform empowers businesses to not only identify the issues material to them, but to go one step further and determine impacts, risks, and opportunities. With these data-driven insights businesses can back up their decisions and focus time and resources on only the issues that matter and develop repeatable, defensible ESG processes and controls. Ensuring they are compliant with even the most stringent regulations, including the European Union’s Corporate Sustainability Reporting Directive (CSRD) which requires this level of detail even for the value chain.

The lack of standardization, the fast-changing landscape and a lack of resources make it difficult to determine what is a material ESG issue. Determining impacts, risks and opportunities adds another layer of complexity for businesses to overcome. Business leaders need data-backed insights on which to base their decisions so they can be confident in their approach and utilize their resources effectively. Reliable and traceable sources of information must be used as stakeholders and auditors seek to understand what informed these decisions. This is especially true for companies subject to the CSRD. Companies that fall under the scope of CSRD, are required to identify, assess, and manage impacts, risks, and opportunities, with monitoring being a key component of the governance expectations. Doing this manually is both challenging and time-consuming.

With the scope of reporting broadening, requiring third-party assurance and including the end-to-end value chain, technology is no longer a nice-to-have but a necessity to support ESG strategy setting and stakeholder engagement. Speaking to the need for a data-driven solution to support the double materiality assessment process, Datamaran client, Piera Ziedek, Team Lead Finance Sustainability at DWS Group said during a recent webinar:

“It boils down to capacity constraints and the fact that the more data I use the less likely an internal auditor or external auditor will tell me this is not representative. Datamaran’s AI can skim through the regulations, the news, and the peer reports for me. And I can still add my methodology that reflects my internal priorities and thresholds to determine what is material. This is therefore the best of both worlds. You have the technology and use it to the advantage that it saves you a lot of time but you can design it in such a way that it makes sense for your company.”

By using the Datamaran platform, companies can take ownership of their ESG strategy, insource the effort, ensure proper ESG governance and comply with CSRD's requirements for a materiality assessment based on double materiality and information relating to the management of impacts, risks and opportunities throughout their value chain. This latest update to Datamaran’s Smart ESG platform continues to set a new gold standard for double materiality as part of Datamaran’s ongoing commitment to provide the ESG community with smart solutions. Datamaran clients can determine, prioritize and categorize material impacts, risks, and opportunities including differentiating what is material to their own operations, their suppliers’ and their corporate customers’. Empowered with these insights, leaders can then decide upon the most appropriate actions and next steps.

Using generative AI and a proprietary large language model purpose-built for ESG, Datamaran gathers the relevant data inputs and surfaces the required insights in real-time giving companies unrivaled completeness and accuracy of information. Our methodology, developed by our in-house experts and vetted by our clients and members of our growing ESG community, is recognized as best practice by EFRAG, and is customizable and explainable to support stakeholder and auditor conversations.

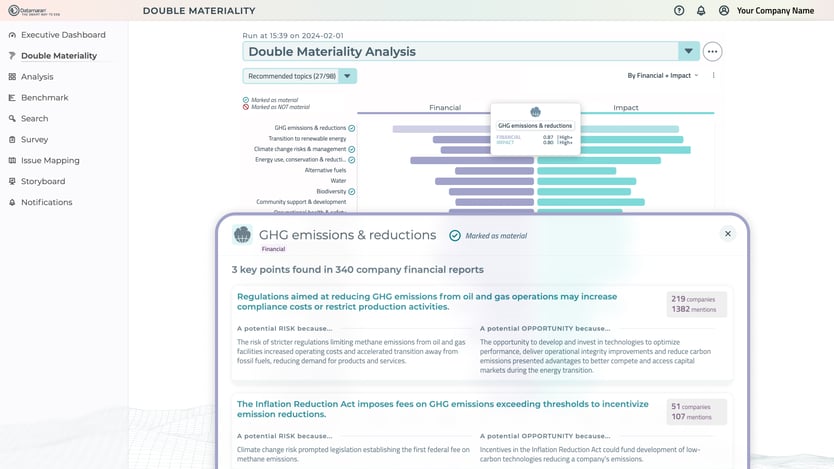

Screenshot of the enhanced Double Materiality module

The release of our Double Materiality AI-powered module follows on from the recent launch of Targets, a new feature that provides a step change in the way that companies set and substantiate their goals and track their progress towards them. In combination, these product capabilities unlock strategic value, giving our clients unprecedented access to robust and reliable information and insights on which to build their strategy and continue with confidence along their ESG and good governance journey.

Brands such as Barclays, Cisco, Kraft Heinz and Marathon Petroleum use Datamaran to take a smarter, faster, more reliable approach to ESG governance and to identify and prioritize the ESG issues material to them. Find out why, by booking a discovery call today.

Follow Datamaran on LinkedIn to stay up-to-date with the latest news, insights and events.